Buying a home is almost certainly going to represent the biggest financial commitment you

undertake in your lifetime. Would you commit to a transaction of this magnitude without knowing

about the condition of the property? At Blackstone Surveyors, we provide a consultancy that helps

buyers during a crucial phase of the buying process and arms them with the understanding to move

forward with conviction.

A one-off survey can not only save you money and a great deal of hassle but can also provide you

with invaluable knowledge about your property.

Contact

Need assistance? Call us for an informal discussion.

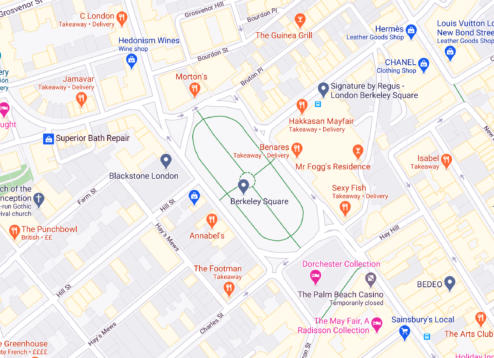

Blackstone Surveyors Ltd

35 Berkeley Square

Mayfair

London W1J 5BF

e: admin@blackstonesurveyors.co.uk

t: 0203 091 85 23

www.blackstonesurveyors.co.uk

VALUATION

We provide formal valuation advice for the following purposes:

•

Probate

•

Matrimonial

•

Capital gains

•

Help to buy

•

Buy to let or Investment

•

Staircasing or selling your share

Alternatively, if you simply wish to know if the price for which you are paying or selling a property is

reasonable, then a standard private valuation is the best option. All our valuations include a building

reinstatement guide.

HOMEBUYER’S REPORT (LEVEL 2 INSPECTION)

Our Homebuyer Survey complies with current RICS guidance and outlines in simple terms the overall

condition of the property. A Homebuyer report, also known as a Level 2 Inspection, is suitable for

properties made from traditional materials. It is also ideal for properties that appear to be in a

reasonable condition with no unusual features. The survey provides advice on the type of construction,

materials used and will report on significant defects as well as common, often hidden, issues. There is

an inspection of all accessible parts of the property, particularly timbers, walls, roofing and rainwater

goods. There is also a formal open market value so that you can be certain that you are paying the

correct market price.

The RICS estimates that the average buyer that fails to commission a survey in advance of purchasing a

property ends up spending £5,750 on remedial works. This is not the kind of news you want to hear

after moving into your new home.

It is therefore highly recommended that you arrange a survey of the property prior to commitment to

purchase so that you can consider any issues and plan accordingly.

NOTE: The mortgage valuation arranged by your lender is NOT the same as a homebuyer’s report. The

lender’s valuation is to protect its security and is not for the benefit of the purchaser.

BUILDING SURVEY

This is the most comprehensive survey we provide and will involve a more thorough inspection of the

entire fabric of the property.

This survey provides all that you would get with a Homebuyers inspection though with much more

detail. The inspection would focus on structural and major defects but will also provide advice on

potential remedial costs and future maintenance. A full costing schedule is also available depending on

your needs. This type of survey would suit older or dilapidated properties but is also recommended on

properties with unusual features, extensions and amendments.

Our Homebuyer and Building Survey service is not merely a standard, tick box exercise. We offer a

consultation in advance of the survey and another after you have received the report. This way, you can

discuss any key issues identified and plan your next steps, including any scope to renegotiate the price.

We also advise on service charge, communal repairs and potential major works costs linked to

purchasing a flat in a block.

LEASE EXTENSIONS AND ENFRANCHISEMENT

The value of a leasehold property is linked to the length of the unexpired lease term. Do you have a

short lease? If so, then you must act decisively and take the correct advice as early as possible. A lease

starts to become very expensive to renew once it falls below 80 years and sellers often struggle to

attract buyers when it falls below 90 years.

There are other implications with a short lease too. Most lenders will not deem the property as suitable

security with a lease shorter than 70 years, significantly reducing saleability. A depreciating lease will

also mean an increasing premium when you come to extend. Therefore, it is vitally important you seek

advice and get the process moving quickly. At Blackstone Surveyors, we offer a straightforward service

that is tailored to your needs including an efficient strategy for negotiating.

We are a firm of independent Chartered Surveyors and Registered Valuers that provide

specialist, tailored advice across a broad spectrum of real estate. At Blackstone Surveyors, we

offer more than merely a prescriptive report devoid of context. The firm has been established

with one primary objective: to provide property owners and prospective buyers with the

correct advice so that they can take appropriate, informed decisions about their property. In

contrast to larger corporate firms that focus on targets, our low volumes enable us to service

our clients’ needs and deliver higher standards.

Our support does not end when your report is released.

Buying a home is almost

certainly going to represent the

biggest financial commitment

you undertake in your lifetime.

Would you commit to a

transaction of this magnitude

without knowing about the

condition of the property? At

Blackstone Surveyors, we

provide a consultancy that

helps buyers during a crucial

phase of the buying process

and arms them with the

understanding to move forward

with conviction.

A one-off survey can not only

save you money and a great

deal of hassle but can also

provide you with invaluable

knowledge about your

property.

Contact

Need assistance? Call us for an informal

discussion.

Blackstone Surveyors Ltd

35 Berkeley Square

Mayfair

London W1J 5BF

e: admin@blackstonesurveyors.co.uk

t: 0203 091 85 23

www.blackstonesurveyors.co.uk

Why choose us?

We are a firm of independent

Chartered Surveyors and

Registered Valuers that provide

specialist, tailored advice across a

broad spectrum of real estate. At

Blackstone Surveyors, we offer

more than merely a prescriptive

report devoid of context. The firm

has been established with one

primary objective: to provide

property owners and prospective

buyers with the correct advice so

that they can take appropriate,

informed decisions about their

property. In contrast to larger

corporate firms that focus on

targets, our low volumes enable us

to service our clients’ needs and

deliver higher standards.

Our support does not end when

your report is released.

VALUATION

We provide formal valuation

advice for the following

purposes:

•

Probate

•

Matrimonial

•

Capital gains

•

Help to buy

•

Buy to let or Investment

•

Staircasing or selling your

share

Alternatively, if you simply wish

to know if the price for which

you are paying or selling a

property is reasonable, then a

standard private valuation is the

best option. All our valuations

include a building reinstatement

guide.

HOMEBUYER’S REPORT

(LEVEL 2 INSPECTION)

Our Homebuyer Survey complies

with current RICS guidance and

outlines in simple terms the

overall condition of the property.

A Homebuyer report, also known

as a Level 2 Inspection, is suitable

for properties made from

traditional materials. It is also

ideal for properties that appear

to be in a reasonable condition

with no unusual features. The

survey provides advice on the

type of construction, materials

used and will report on

significant defects as well as

common, often hidden, issues.

There is an inspection of all

accessible parts of the property,

particularly timbers, walls,

roofing and rainwater goods.